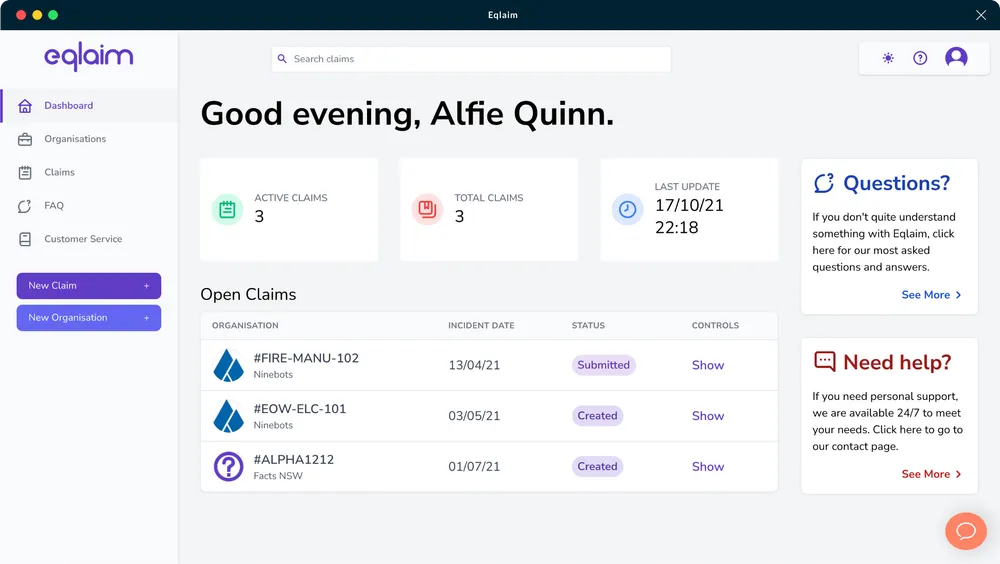

Streamlining Ocean Marine Cargo Insurance Claims with Automation

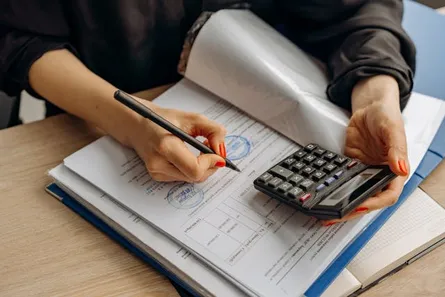

As industry professionals, we know that high-frequency, low-value claims in ocean marine cargo insurance can overwhelm traditional claims processes. The volume of minor claims—damaged shipments, delays, and lost cargo—often bogs down teams, impacting efficiency and customer satisfaction. Automation offers a way forward, transforming the way we handle these claims.Automated Documentation and Reporting: Automation can instantly capture and submit documentation, from photos of damaged goods to shipment manifests. This reduces the burden on the insured and speeds up the reporting process, ensuring claims are filed within the necessary timeframes.Accelerating Claim Adjudication: By using AI-powered claims adjudication systems, low-value claims can be reviewed and processed in a fraction of the time it would take manually. Automation algorithms assess claim validity against policy terms, reducing human error and increasing throughput.Improved Customer Experience: Clients expect fast resolutions. With automation, carriers can offer real-time updates and near-instant claim processing, significantly improving customer satisfaction while keeping operational costs in check.For high-volume claims environments like ocean marine cargo, automation isn't just an option—it's a necessity for staying competitive and maintaining customer trust.